Our Finite World's excellent Gail the Actuary explains:

Economic Expansion vs. Economic Contraction

It is easy to assume that economic contraction is similar to economic expansion, just with the sign reversed, but anyone who has lived through the last few years knows that this is not the case.

For example, on the way up, it appears that the size of the current economic system easily “scales” upward, as the economy grows. The number of available workers gradually rises, as does the number of job openings, and the amount of goods and services produced. Everything rises together, and the system “works.”

On the way down, there is a good deal more “stickiness” to the system. There are now seven billion people on the planet, and they all would like to eat on a regular basis. There are perhaps two-thirds as many potential workers, and most of them would like to have jobs, even if the economy is contracting, and their particular job is disappearing.

Another issue is that we have built millions of miles of electrical transmission, oil and gas pipelines, water and sewer pipelines, and roads. It becomes difficult to abandon parts of these systems, even if total resources for maintaining the system are constricted. If we think of the situation in terms of tax dollars (or charges by utility companies), it becomes increasingly difficult to collect enough tax dollars (or utility charges) to pay for the inflated cost of replacing worn out roads, pipelines, and electrical transmission, as the rising price of oil makes these costs rise much more rapidly than salaries.

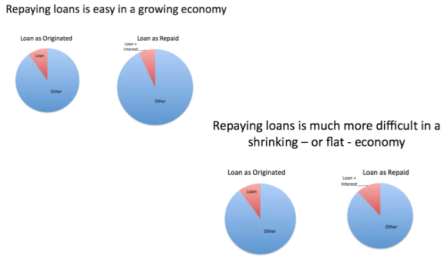

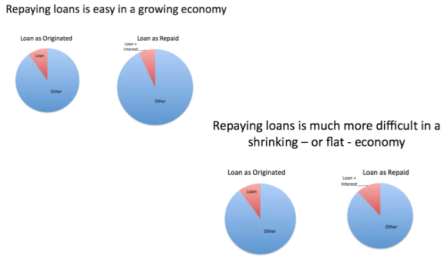

Figure 2. Repaying loans is easy in a growing economy, but much more difficult in a shrinking economy.

Another issue is debt repayment (Figure 2). We are used to an ever-expanding economy, where future goods and services produced will always be greater than those produced this year. As long as this growth pattern persists, our system of long-term financing of major expenditures, even if the expenditures are not really income producing, can continue. For example, we are able to buy homes with 20 or 30 year loans, and governments are able to continue borrowing, claiming that they will have more funds to repay loans (with interest) in the future. Once the situation changes to a shrinking economy, it becomes much more difficult to repay loans, and the financial system quickly reaches the risk of collapsing, due to multiple debt defaults.

A related issue is that of financing a new or expanding company. If the economy continues to grow, investment in a new company is likely to make sense because the value of the company can be expected to grow as the demand for products of the type it sells continues to grow. But if it becomes clear that the economy is on a path of long-term contraction, the possibility of failure within a few years rises, so new investment makes much less sense. . . .